The Hosting Insight

Your go-to source for the latest in web hosting news and tips.

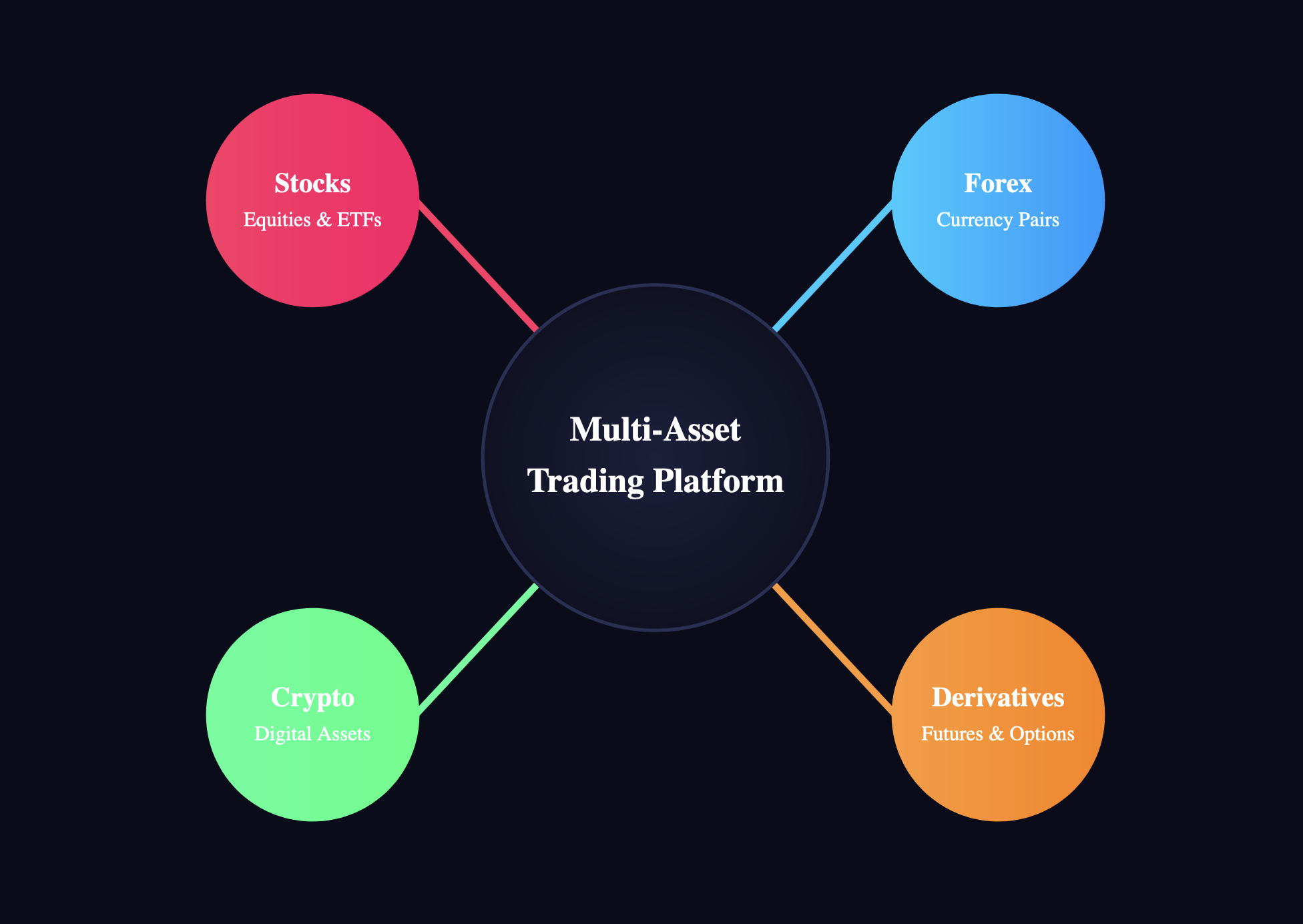

Trading Tricks for Digital Assets: Navigating the Virtual Wild West

Discover essential trading tricks for digital assets and master the virtual wild west. Uncover tips to boost your gains and outsmart the market!

Understanding Volatility: Key Strategies for Trading Digital Assets

Understanding volatility in the digital asset market is crucial for both novice and experienced traders. Volatility refers to the rapid and significant price movements that can occur in cryptocurrencies and other digital assets. While this can pose risks, it also presents unique trading opportunities. By analyzing market trends and price fluctuations, traders can position themselves to capitalize on short-term gains. An effective strategy is to utilize technical analysis, which involves examining price charts and indicators to predict future movements. Keep an eye on market sentiment, as it can greatly influence volatility.

Moreover, employing risk management techniques is essential when navigating the fluctuating landscape of digital assets. One effective tactic is to set stop-loss orders, which automatically sell your asset if it drops to a certain price, minimizing potential losses. Additionally, diversifying your portfolio can help mitigate risk, as not all assets will react the same way during periods of high volatility. Implementing these strategies can enhance your trading effectiveness and allow you to thrive in the dynamic world of digital asset trading.

Counter-Strike is a popular first-person shooter game that pits teams against each other in strategic combat. Players can enhance their gaming experience by utilizing various skins and weapons, and those looking for deals might want to check out the daddyskins promo code to get the most out of their inventory.

Top 5 Mistakes to Avoid When Navigating the Crypto Market

When venturing into the unpredictable world of cryptocurrencies, one must be cautious to avoid common pitfalls. One major mistake is not doing enough research before investing. Investors often get drawn into the hype surrounding certain coins without understanding the underlying technology or the team behind them. This can lead to poor investment choices and substantial losses. To mitigate this risk, it’s essential to thoroughly analyze market trends, utilize resources such as whitepapers, and gather insights from credible sources.

Another critical error is letting emotions drive decisions. The crypto market is notorious for its volatility, and inexperienced traders may panic during downturns or become overly enthusiastic during upswings. Instead of making impulsive trades driven by fear or greed, it’s important to establish a solid investment strategy and adhere to it. Utilizing tools like stop-loss orders and diversification can help maintain a balanced approach, ensuring that you're not swayed by short-term market fluctuations.

How to Analyze Crypto Trends: Tools and Techniques for Success

Understanding how to analyze crypto trends is essential for anyone looking to succeed in the ever-evolving world of cryptocurrency. Various tools and techniques can help you stay ahead of the curve and make informed decisions. First, utilizing charting software like TradingView allows you to visualize price movements and spot patterns. Moreover, on-chain analysis tools like Glassnode provide insights into network activity and investor behavior, giving you an edge in predicting market shifts.

Aside from dedicated software, employing fundamental analysis (FA) is crucial. This involves examining a cryptocurrency's underlying technology, team, and market demand. You can also track social media sentiment using platforms like LunarCrush, which aggregates community opinions and trends. Combining these techniques with technical analysis (TA) can vastly improve your ability to identify crypto trends. Remember, staying informed and adaptive is key to navigating the dynamic landscape of cryptocurrency successfully.