The Hosting Insight

Your go-to source for the latest in web hosting news and tips.

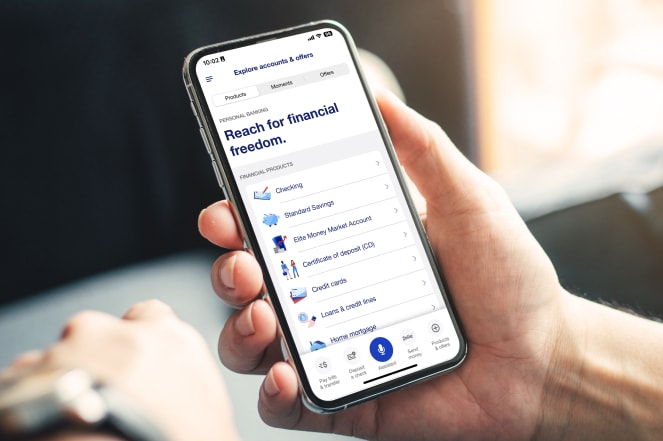

Money Talks: Deciphering Your Bank's Hidden Language

Unlock the secrets of your bank's lingo and make smarter money moves! Discover hidden meanings that could boost your financial future today!

Understanding Banking Jargon: A Glossary of Common Terms

Banking jargon can often be perplexing for those unfamiliar with the financial world. Understanding key terms is crucial for making informed decisions about your finances. Here’s a brief glossary of common terms that can help demystify the banking language:

- APR (Annual Percentage Rate): This refers to the yearly interest rate charged for borrowing or earned through an investment, expressed as a percentage.

- FDIC (Federal Deposit Insurance Corporation): A government agency that insures deposits in banks and thrift institutions to protect depositors.

- Loan-to-Value Ratio (LTV): This metric measures the ratio of a loan to the value of an asset purchased, often used in mortgage lending.

Another essential aspect of banking terminology involves different types of accounts and services. Gaining clarity on these terms can enhance your understanding of banking operations:

- Savings Account: An account designed to hold money that you do not need immediate access to, often earning interest.

- Checking Account: A transactional account that allows for deposits and withdrawals, typically used for daily expenses.

- Overdraft: This occurs when withdrawals from a bank account exceed the available balance, resulting in a short-term loan from the bank.

Are You Paying Too Much? Unpacking Bank Fees and Charges

Bank fees and charges can often feel like a mystery, leading many customers to wonder, Are you paying too much? From monthly maintenance fees to ATM withdrawal charges, it's essential to understand where your money is going. Start by reviewing your bank statements to identify recurring fees and explore the various types of charges that may apply. Some common bank fees include:

- Monthly maintenance fees

- ATM usage fees

- Overdraft charges

- Wire transfer fees

- Account closure fees

To address the question of whether you are indeed paying too much, consider switching to a bank that offers a more favorable fee structure. Comparing different banks can reveal significant savings and better value for your money. Additionally, inquire about ways to waive fees, such as maintaining a minimum balance or setting up direct deposits. Remember, the more aware you are of the charges your bank imposes, the better equipped you'll be to make informed financial decisions and protect your hard-earned money.

The Secrets of Your Credit Report: What Your Bank Isn't Telling You

Your credit report is a crucial document that holds the key to your financial future, but many people remain unaware of its significance and the secrets it contains. Credit reports are compiled by credit bureaus and include vital information such as your credit history, outstanding debts, and payment habits. Understanding the details of your report can help you identify areas for improvement and make informed decisions about future credit applications. Even your bank might not disclose everything, leaving you in the dark about what lenders really consider when evaluating your creditworthiness.

One of the secrets of your credit report is how each aspect impacts your overall credit score. For instance, a late payment can significantly drop your score, while a long history of timely payments can enhance it. Additionally, banks often look at your credit utilization ratio, which is the amount of credit you’re using compared to your total available credit. Keeping this ratio below 30% is generally recommended. It’s crucial to regularly review your credit report, correct any errors, and understand the factors influencing your score, as this knowledge empowers you to take control of your financial health and makes you a more attractive candidate for favorable loan terms.