The Hosting Insight

Your go-to source for the latest in web hosting news and tips.

Why Your House is a Money Pit and How to Fix It

Discover the hidden costs of your home and expert tips to turn your money pit into a worthy investment—don't let repairs drain your wallet!

Understanding the Hidden Costs: Why Your House Becomes a Money Pit

Owning a home can often feel like a dream come true, but understanding the hidden costs is crucial. Beyond the obvious expenses like mortgage payments and property taxes, homeowners frequently encounter unexpected financial burdens. For instance, routine maintenance such as plumbing repairs, roof replacements, and HVAC system servicing can quickly add up. According to a report by the U.S. Department of Housing and Urban Development, homeowners should budget approximately 1% of their home's value each year for ongoing maintenance. This often overlooked expense can lead to significant financial strain if not planned for properly.

Furthermore, other factors contribute to the money pit dilemma. Issues like property insurance, increasing utility costs, and special assessments for community improvements can catch many homeowners off guard. It is essential to develop a comprehensive budget that includes these potential hidden costs. For more insights, you can explore Forbes' guide on hidden costs of homeownership. By understanding these financial obligations, prospective buyers can make more informed decisions and avoid properties that will drain their finances over time.

Top 10 Common Homeowner Mistakes That Turn Your House into a Financial Burden

Owning a home can be one of the most significant financial investments for many people. However, common homeowner mistakes can quickly turn that investment into a financial burden. From neglecting routine maintenance to making impulsive renovation decisions, these errors can lead to costly repairs and lowered property value. According to HUD, many homeowners overlook essential maintenance tasks, such as checking for leaks and servicing heating and cooling systems. Regular upkeep is crucial to ensuring that your home remains a safe and comfortable place to live, while also protecting your investment.

Another mistake homeowners often make is failing to plan for unexpected expenses. Many people underestimate the costs associated with homeownership, including property taxes, insurance, and routine upkeep. A report by NAHB indicates that overspending on a mortgage can lead to significant financial strain. It's essential to create a budget that accounts for these hidden costs and to set aside an emergency fund for any unanticipated repairs. Being proactive can help you avoid turning your home into a financial burden.

Is Your Home Draining Your Wallet? Signs and Solutions for a Money Pit

Your home can sometimes feel like it's draining your wallet without you even realizing it. Money pits can manifest in various ways—from skyrocketing utility bills to costly repairs that seem to pop up out of nowhere. If you've noticed frequent plumbing issues, drafty rooms, or cracks in your walls, these could be signs that your home is not just a cozy retreat but a potential financial burden. According to NerdWallet, homeowners should allocate 1% of their home's value annually for maintenance. Ignoring these signs could lead to much larger expenses in the future.

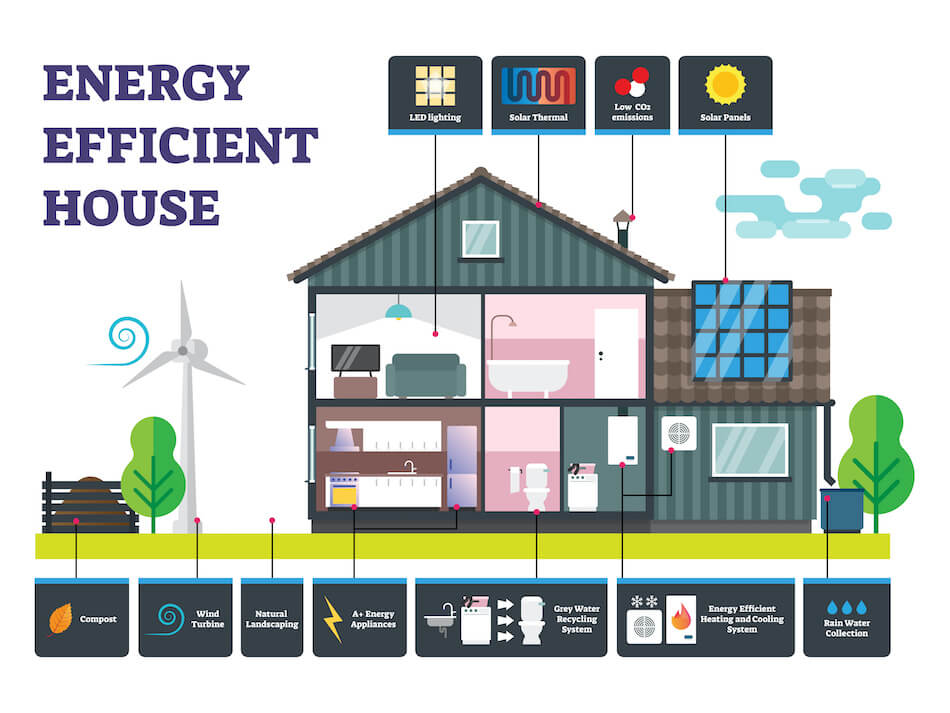

Fortunately, there are solutions to help you avoid letting your home become a money pit. Regular maintenance is key; a simple inspection of your HVAC system can prevent major breakdowns later on. Additionally, consider investing in energy-efficient appliances and sealing any gaps that may contribute to energy loss, which you can read more about on Energy.gov. Lastly, if you find yourself constantly fixing the same issues, it may be wise to consult with a professional contractor who can offer long-term solutions rather than just quick fixes.