The Hosting Insight

Your go-to source for the latest in web hosting news and tips.

Life Insurance: The Safety Net Everyone Pretends They Don’t Need

Discover why life insurance is the safety net you can't afford to ignore. Protect your loved ones today!

What is Life Insurance and Why It's Essential for Your Financial Security?

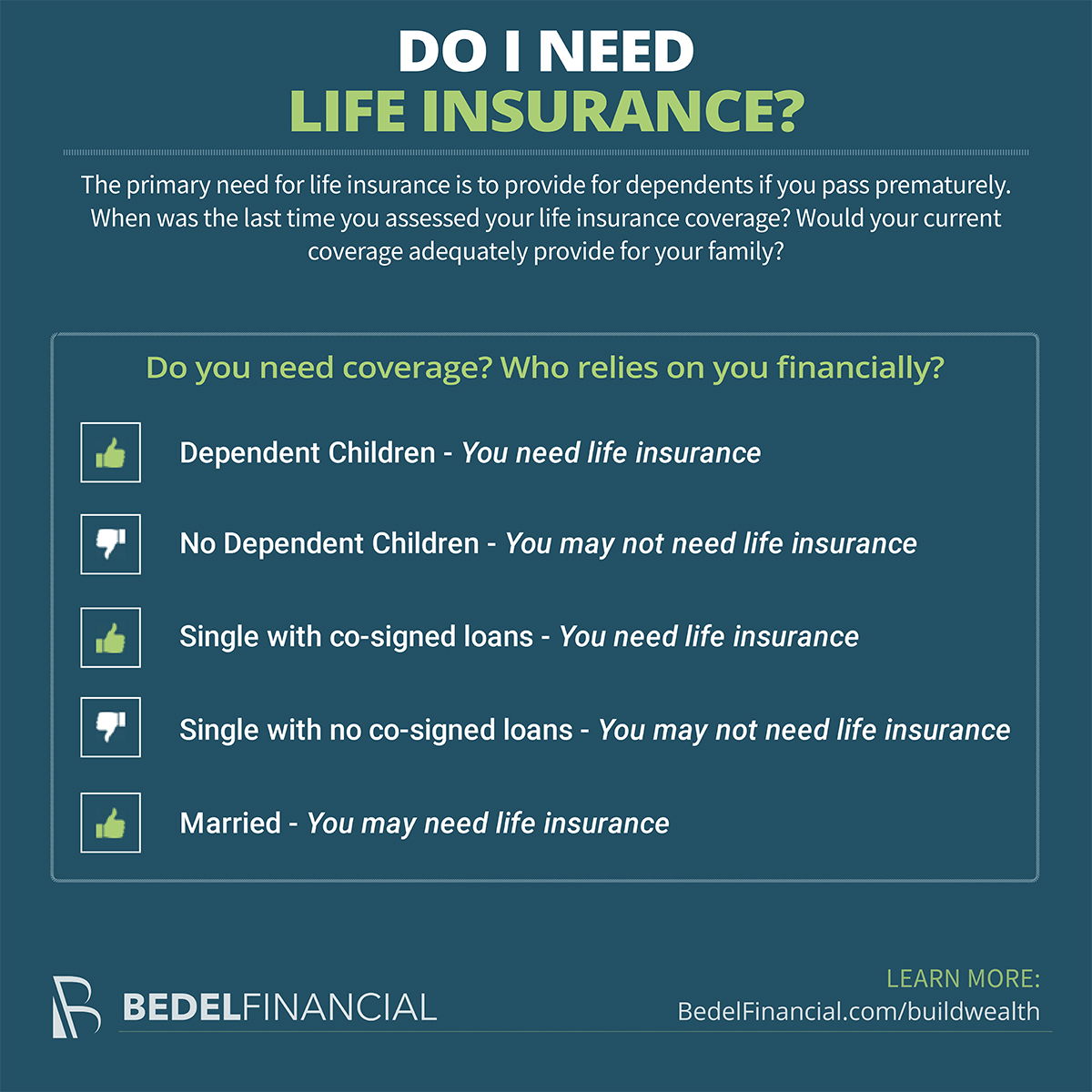

Life Insurance is a financial product designed to provide monetary support to beneficiaries upon the policyholder's death. It serves as a safety net, ensuring that loved ones are not left in financial distress during difficult times. By paying regular premiums, individuals can secure a predetermined sum, which can be used for various purposes such as covering daily expenses, paying off debts, or funding future goals like children's education. According to Investopedia, life insurance is crucial for anyone who has dependents or significant financial obligations, as it provides peace of mind and financial stability.

Understanding the importance of life insurance goes beyond just initial costs; it's an investment in your family's future. When you have a policy in place, you can ensure financial security that can cover living expenses, mortgage payments, and even college tuition for your children. This consideration is especially vital as unexpected events can drastically impact long-term financial planning. According to the National Organization of Life Insurance, life insurance acts as a fundamental building block of financial security, making it an essential part of any comprehensive financial plan.

The Top 5 Myths About Life Insurance Debunked

Life insurance is often shrouded in misconceptions that can deter individuals from making informed financial decisions. One prevalent myth is that life insurance is too expensive for the average person. In reality, premiums can vary significantly based on factors such as age, health, and the type of policy chosen. According to a report by the Nationwide Insurance, many individuals overestimate the cost of coverage, leading them to dismiss it altogether. Another common myth is that only those with dependents need life insurance. This is misleading, as life insurance can also play a vital role in covering debts and protecting a person's estate, regardless of their family situation.

Additionally, many people believe life insurance only pays out after death, overlooking the options available for living benefits, such as critical illness or long-term care riders. These options can provide financial support during challenging times. Furthermore, the myth that older individuals cannot obtain life insurance is not entirely accurate. While age can impact premiums, many companies offer policies specifically designed for older applicants. Debunking these myths can empower individuals to assess their financial needs realistically and consider the beneficial role that life insurance can play in their overall financial plan.

How to Choose the Right Life Insurance Policy for Your Needs

Choosing the right life insurance policy for your needs involves several critical considerations. Firstly, assess your financial situation and determine how much coverage you require. A good rule of thumb is to aim for a policy amount that is at least 10-15 times your annual income, but this can vary based on your specific circumstances, such as debts, dependents, and future financial obligations. For a detailed guide on calculating your life insurance needs, you can refer to Investopedia. Secondly, consider the type of life insurance policy that best suits your situation. The two main categories are term life insurance and permanent life insurance. While term insurance provides coverage for a limited period, permanent insurance lasts your entire lifetime, adding a cash value component.

It's crucial to shop around and compare quotes from different insurance companies before making a decision. Online tools and calculators can help you estimate premiums and policy benefits, so utilize resources like Policygenius for a comprehensive comparison. Additionally, reviewing customer reviews and the financial ratings of insurance providers can help you gauge their reliability and level of service. Finally, don't hesitate to consult a financial advisor or insurance professional; they can provide personalized advice tailored to your unique needs and help you navigate the complexities of various policies to find the best fit.